In today’s competitive real estate market, where demand often surpasses the supply of available homes, buying a house can feel like a marathon rather than a sprint. If you’re not fortunate enough to find a budget-friendly home immediately and have your first offer accepted, you may experience buyer’s fatigue. This can lead to frustration-fueled decisions or even giving up on the process altogether. To help you stay on track, here are some common mistakes fatigued homebuyers make and how to avoid them.

Mistake #1: Skipping Pre-Approval

One of the best ways to prevent homebuying fatigue is to set yourself up for success from the beginning by getting pre-approved for a mortgage. The primary benefits of pre-approval are twofold:

- Competitive Offers: Your offers will be more competitive with the backing of a lending institution, assuring sellers that you’re serious and capable of securing a mortgage.

- Budget Clarity: You’ll have a clear understanding of your budget, based on the loan amount pre-approved for you.

Skipping the pre-approval process and waiting until you find the “perfect” home to see if you qualify for a loan can result in losing out to buyers who are already preapproved and seen as more reliable.

Need to get started with a pre-approval? You can use our easy online pre-approval application or give us a call to speak with a Loan Officer at 888-616-9885.

TIP: After getting preapproved, use our home affordability calculators to determine how much house you can afford based on factors like down payment and monthly mortgage payments. Set a realistic range for your purchase price, including a target price and an absolute maximum, to save time and avoid looking at homes beyond your budget.

Mistake #2: Comparing Homebuying to Renting

As a first-time homebuyer, you’ve likely had experience with renting. However, the process of purchasing a home is significantly different from renting, involving much more time, paperwork, and strategic planning.

A study from money.com in 2021 revealed that the average first-time homebuyer toured 15 properties, with one-third touring over 20 homes. Additionally, 98% of respondents did not have their first offer accepted, often facing multiple rejections before finally succeeding. Unlike renting, where you might relocate every few years, homeowners typically stay in their homes for an average of 12 years.

TIP: Increase your chances of winning an offer by getting creative with partial contingencies, buydowns, flexible closing dates, and more. Contact a Greenway Loan Officer to learn more.

Mistake #3: Relying Solely on Public Listing Sites

Relying solely on public listing websites like Zillow and Realtor.com can put you at a disadvantage. Real estate agents have access to a database that shows homes before they’re publicly listed, providing more details and the date the house will officially go on the market.

If you coordinate with your realtor, you might be able to schedule a showing before the home is listed on Zillow.

Mistake #4: Navigating the Market Without Expert Guidance

Working with a real estate agent offers numerous benefits beyond early access to listings. A knowledgeable agent can help you craft a competitive offer, understand the neighborhood, decide whether to waive contingencies, and navigate other tough decisions. Having professional guidance can make a significant difference in securing your first home.

Need a local real estate agent? We have connections—give us a call and we’ll put you in touch. 888-616-9885

Bottom Line:

Navigating the homebuying process can be daunting, especially for first-time buyers. By avoiding these common mistakes—getting preapproved, treating the process with the gravity it deserves, leveraging professional tools, and working with a real estate agent—you can minimize fatigue and increase your chances of success. Stay informed, be prepared, and remain patient to make your dream of homeownership a reality.

Monmouth County, NJ’s First-Time Homebuyers Assistance Program

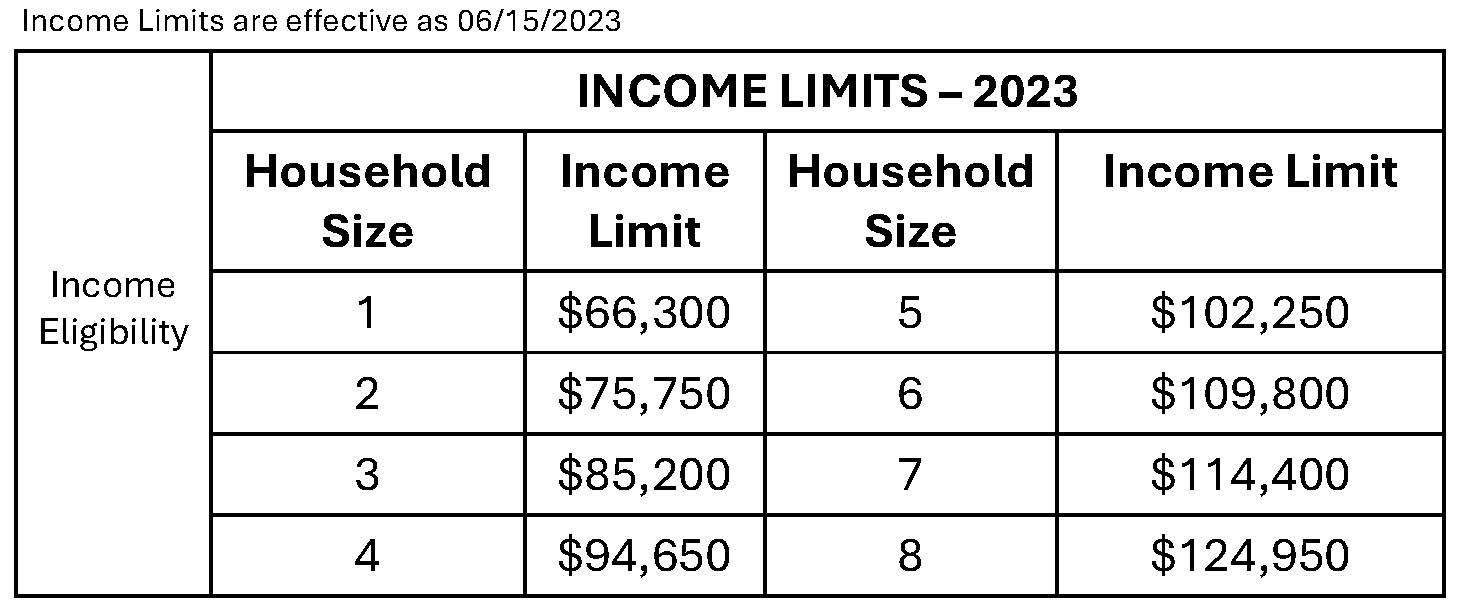

Are you dreaming of owning your first home but struggling to navigate the complex world of down payments and closing costs? Look no further! The Monmouth County, NJ First-Time Homebuyers Assistance Program is here to turn your homeownership aspirations into reality. In this blog, we'll explore the ins and outs of this program, including eligibility criteria, program details, and the participating municipalities that could become your new home.

Understanding the Program

The Monmouth County, NJ First-Time Homebuyers Assistance Program is tailored to provide financial support to low-income families aiming to purchase an affordable home. The program offers a deferred payment second mortgage loan, granting up to $10,000 specifically for down payment and closing costs. Let's delve into the essential details and eligibility criteria:

1. Residency Requirement

To qualify for the program, applicants must have been residents of Monmouth County for at least one year before applying for the grant.

2. Pre-purchase Housing Counseling

All applicants are required to complete a pre-purchase housing counseling course and provide a certificate of completion with their First-Time Homebuyer application. This step is crucial to empower potential homeowners with the knowledge and skills needed for a successful homeownership journey.

3. First-Time Homebuyer Criteria

To be eligible, individuals must meet the first-time homebuyer criteria, meaning they have never owned a home before. (except if an applicant has previously owned a home, he/she still may qualify if they meet 1 or more of the following criteria:

- An individual that has not owned a home in 3 years prior to receiving home assistance.

- An individual who is a single parent even if the individual owned a home with his or her spouse or resided in a home owned by the spouse.

- An individual who is a displaced homemaker even if as a homemaker the individual owned a home with his or her spouse or resided in a home owned by the spouse.

Navigating the Fine Print

While the program is designed to make homeownership accessible, there are specific guidelines and conditions applicants must be aware of:

- The purchased property must be the principal residence.

- The home must be in one of the participating municipalities* listed below.

- First-time homebuyer can only purchase a 1-4 family property or condominium unit.

- Housing unit cannot exceed the max purchase price of $461,000 for 1-family & condominium, $590,000 for 2-family unit, $714,000 for a 3-family unit and $885,000 for a 4-family unit.

- Mobile homes are not eligible for purchase using First-time Homebuyer program funds.

- Co-signor not allowed

- Eligibility requirements, exclusions and other terms and conditions apply.

Participating Municipalities:

*Participating Municipalities: Aberdeen, Fair Haven, Marlboro, Shrewsbury Borough, Allenhurst, Farmingdale, Matawan, Shrewsbury Twp, Allentown, Freehold Borough, Middletown, South Belmar, Atlantic Highlands, Freehold Twp, Millstone, Spring Lake, Asbury Park, Hazlet, Monmouth Beach, Spring Lake Heights, Avon, Highlands, Neptune Twp, Tinton Falls, Belmar, Holmdel, Neptune City, Union Beach, Bradley Beach, Howell, Ocean, Upper Freehold, Brielle, Keansburg, Oceanport, Wall, Colts Neck, Keyport, Red Bank, West Long Branch, Deal, Loch Arbour, Roosevelt, Eatontown, Long Branch, Rumson, Englishtown, Manalapan, Sea Bright.

Bottom Line:

The Monmouth County, NJ First-Time Homebuyers Assistance Program is designed to support you in achieving your dream of homeownership. Take the first step towards a brighter future by exploring the possibilities this program opens up for you in these vibrant communities.

Don't let financial barriers hold you back. Click here to start your free pre-approval today or contact us for more information and to see if you’re eligible.

Helpful Mortgage Resources

Struggling to save up for a down payment on a new home?

Saving up to buy a home can feel nearly impossible. But with a solid saving game plan, anyone can squirrel enough away for a down payment on the home of their dreams. There are many simple strategies you can use to make saving a breeze and we’ll cover those in a few.

How Much Do You Need to Save For Your Down Payment?

You’re probably familiar with the phrase: Save for a 20 percent down payment before you buy a home. Putting this much down shows that you have financial discipline and stability. Plus, it can help you get more favorable rates. While a 20 percent down payment was once a standard, many home buyers now pay 5% or less. In fact, there are some programs that allow you to put down as little as 3.5%.

Where Did The 20% Myth Come from?

The 20% myth comes from the private mortgage insurance (PMI) rule that some lenders and investors have. If you have less than 20% down at closing, you may need to pay for PMI. On the flip side, if you put 20% or more down on a home at closing, you do not have to pay the private mortgage insurance. Overall, putting 20% down will save you money over time.

What are the Benefits of a 20% Down Payment?

Lower Interest Rate

Putting 20% down vs. 3.5% down shows your lender that you're more financially stable and not a large credit risk.

Pay Less For Your Home

The larger your down payment, the smaller your loan amount will be for your mortgage. For instance, if you decide to put 20% down, you'll only pay interest on the remaining 80%.

Stand Out in a Competitive Market

The housing market is still hot, and many buyers are competing for the same home. In turn, a 20% down payment to a seller is key because you are seen as a stronger buyer then someone puts only 3.5% down.

You Won't Have to Pay Private Mortgage Insurance (PMI)

Again, when you put less than 20% down when buying a home, your lender will see your loan as having more risk. PMI helps lenders recover their investment if you're unable to pay back the loan. PMI is not required if you put 20% or more down.

3 Down Payment Game Plan Saving Strategies:

Build A Better Budget:

-

You’ll want to sit down and figure out where you’re spending the most money. You may even want to download a budgeting app!

-

Figure out how much you spend on necessities like rent, car payment, utilities, etc.

-

Figure out how much you spend on nonessentials like entertainment, restaurants, etc.

-

After categorizing your expenses, set a realistic dollar amount that you can put aside each month that you’re comfortable with. Consider these savings a non-optional expense!

Reduce Your Expenses

If you're prone to impulse shopping online, consider cutting down on those purchases! Plan to cook at home and focus on eating out less frequently!

Automate Your Savings:

-

Decide how much you want to save per month for your down payment.

-

Contact your bank and authorize an automatic withdrawal from your primary account into a separate savings account.

-

Your bank will automatically take money out of your account each month and put it into a separate account.

Bottom Line

If you want to save for a house, you’ll want to have a solid savings game plan. Figure out how much you need to put away each month. Remember, you don’t always have to put 20% down. There are other options, and we are happy to discuss them with you.

Still have some down payment questions rolling around in your head? Contact the experts at Greenway! We'll help guide you in the right direction towards your homeownership goals.

It’s no lie, the housing market has been wild. If you’re a first-time homebuyer, don’t lose faith in finding your first home. You have options. Sometimes thinking outside the box can lead you in the right direction. Here are a few things to consider:

Your Budget

Have you crunched the numbers yet to see how much you can afford? If you’re unsure of your magic number, reach out to the experts at Greenway Mortgage. We’ll look at your finances and assess what you can borrow.

Consider a Condo or a Townhouse

Condos and Townhouses make great starter homes. In fact, they’ll help you build equity to fuel a move when you’re ready!

Click here to find out if Townhouse Living or Condo Living is right for you.

Expand Your Radius

Widening your radius to include nearby neighborhoods or communities can help you find a hidden gem.

Weight Your Must-Have and Nice-To-Haves

Not finding the perfect house? Take another look at your desired features and see if any are nice-to-have instead of essential. Work with your trusted real estate agent and let them know what your wants and needs are.

Greenway Mortgage is Here To Help Guide You!

As a first-time homebuyer, there are a variety of different mortgage programs available to you. Some include:

- No Money Down FHA Loan

- NJ FHA Down Payment Assistance Program

- Conventional 97 First-Time Home Buyer Program

- The HomeReady Program

- FHA Mortgage

- Monmouth County, NJ First-Time Home Buyer Program

We also have a variety of tools and resources to help you through your home buying journey. Whether you’re just starting to save or you already have a house in mind, we can help you get your keys to your first home.

- Free First-Time Buyer Guide: Learn how to navigate the entire home buying process from pre-approval to closing and beyond!

- Home Buying Comparison Chart: Be sure to take this handy chart along with you during your home search.

Your first home is out there. Work with your real estate agent and loan officer to stay up to date on all your options and to find out what other first-time homebuyers are doing to find their dream homes.

Reach out when you’re ready to take the next step! We are here to help.

What Documents Do I Need for A Mortgage Pre-Approval?

-

Get a FREE Pre-approval (takes less than 5 minutes)

.png)

.png)