-

Ask your inspector if you can tag along. This way you can explore your new home in detail and ask questions as you go. This process can give you much more information than the report alone.

-

A home inspection can take 2-4 hours, but may take more time depending on the size of the house.

-

Don’t be surprised if you see the inspector climbing on the roof or crawling around in the attic and on the floors.

-

Roof

-

Plumbing

-

Electrical components

-

Appliances

-

Heating and air conditioning systems

-

Ventilation

-

Windows

-

Basement

-

Structural components

-

Fireplace and chimney

-

Foundation, and so much more

Did you know that you do not need a down payment of 20% to buy a home? In fact, according to data from the National Association of Realtors, over half of home buyers make down payments of less than 6%. Yes, that’s correct!

Of course, the advantage of a larger down payment is the potential for lower borrowing costs. In turn, this results in a smaller monthly mortgage payment. In the end, it all depends on your specific situation.

Benefits to Buying a House with A Small Down Payment

There are some positives to buying a house with little or no down payment as well. For instance, once you make a down payment, you can only access that money via a home loan refinance or the sale of your home. With little or no money down, you avoid the risk of depleting your savings. It’s important to keep in mind that you may need some extra money for repairs and maintenance. Bottom line, you’ll always want to have some savings left after you buy.

Low or No Down Payment Loan Options are Available

There are many low or no down payment options available. What it comes down to is your eligibility. Take for example, these 2 government-insured loan programs:

Department of Veterans Affairs (VA) Loan: VA loans are a special type of home mortgage reserved for active military members and veterans. These home loans are guaranteed by the U.S. Department of Veterans Affairs and offered by participating approved lenders such as Greenway Mortgage. VA loans are designed to provide long-term home financing to qualified veterans and, in some cases, their surviving unmarried spouses. In many instances, their interest rates can be better than other conventional loans. Learn more about the VA Loan here.

United States Department of Agriculture (USDA) Loan: This program is offered to rural property owners with a low-to-moderate income for their area. Learn more about the USDA Loan here.

Down Payment Assistance (DPA) Programs

There are even down payment assistance programs that are designed for home buyers who can afford monthly mortgage payments but don’t have enough money for a down payment. These programs are available county-by county to offer first-time homebuyers’ relief from the costs of purchasing a home. The assistance is provided in form of a loan or grant. Learn more about NJ’s FHA Down Payment Assistance Program here.

Are You Ready to Get Started?

Greenway Mortgage is ready to help you get into the home of your dreams this year. We have many down payment assistance programs that can help you become a homeowner. Start your home buying process today by determining the annual income you’ll need to buy a house. Use our affordability calculator here.

If you’re ready to get pre-approved, you can visit us online here or give us a call 732.832.2967. We are happy to answer any of your questions, choose the right mortgage program for you, as well as walk you through the process from start to finish!

In today’s market, low inventory dominates the conversation in many areas of the country. It can often be frustrating to be a first-time homebuyer if you aren’t prepared. Here are five tips from realtor.com’s article, “How to Find Your Dream Home—Without Losing Your Mind.”

1. Get Pre-Approved for a Mortgage Before You Start Your Search

One way to show you’re serious about buying your dream home is to get pre-qualified or pre-approved for a mortgage. Even if you’re in a market that is not as competitive, understanding your budget will give you the confidence of knowing whether or not your dream home is within your reach. This will help you avoid the disappointment of falling in love with a home well outside your price range.

2. Know the Difference Between Your ‘Must-Haves’ and ‘Would-Like-To-Haves’

Do you really need that farmhouse sink in the kitchen to be happy with your home choice? Would a two-car garage be a convenience or a necessity? Before you start your search, list all the features of a home you would like. Qualify them as ‘must-haves’, ‘should-haves’, or ‘absolute-wish list’ items. This will help you stay focused on what’s most important.

3. Research and Choose a Neighborhood Where You Want to Live

Every neighborhood has unique charm. Before you commit to a home based solely on the house itself, take a test-drive of the area. Make sure it meets your needs for “amenities, commute, school district, etc. and then spend a weekend exploring before you commit.”

4. Pick a House Style You Love and Stick to It

Evaluate your family’s needs and settle on a style of home that will best serve those needs. Just because you’ve narrowed your search to a zip code doesn’t mean you need to tour every listing in that vicinity. An example from the article says, “if you have several younger kids and don’t want your bedroom on a different level, steer clear of Cape Cod–style homes, which typically feature two or more bedrooms on the upper level and the master on the main.”

5. Document Your Home Visits

Once you start touring homes, the features of each individual home will start to blur together. The article suggests keeping your camera handy and making notes on the listing sheet to document what you love and don’t love about each property you visit.

Bottom Line

In a high-paced, competitive environment, any advantage you can give yourself will help you on your path to buying your dream home. Get started today by getting pre-approved!

Helpful Resources

- Spring Home Buyer Guide - FREE!

- First-Time Home Buyer Resources

- Buying Your First Home

- Mortgage Calculators

- Contact Us

- Greenway's Blog

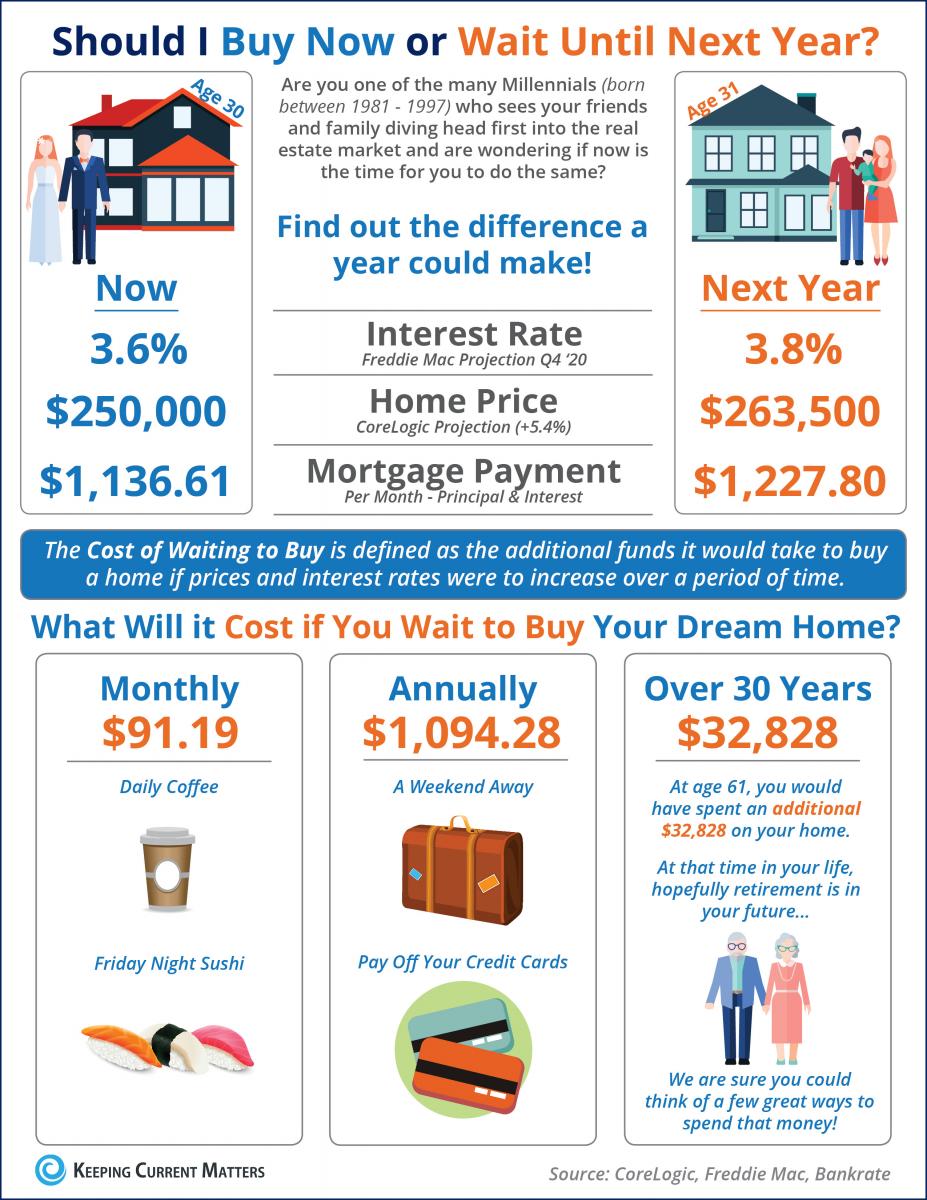

Are you one of the many millennials who sees your friends and family diving head first into the real estate market and are wondering if now is the time for you to do the same?

The “cost of waiting to buy” is defined as the additional funds it would take to buy a home if prices and interest rates were to increase over a period of time.

Let’s take a look at some predications: Freddie Mac forecasts that interest rates will rise to 3.8% by Q4 2020. In addition, CoreLogic predicts that home prices will appreciate by 5.4% over the next4 12 months!

So… perhaps it is time to lose the lease in 2020 to save yourself from rising rents and own your own home? Remember, there are SO many benefits to owning your own home. For instance, buying a home is an investment in your future.

- Homeownership builds equity every single month

- Provides stability – rent prices increase 4% annually

- Your mortgage is like a forced savings plan

- Possible tax benefits (talk to your CPA to see which benefits apply to you)

- And so much more!

Take a look at the infographic here – perhaps this will change your mind.

When you're ready to take the next step, Greenway Mortgage is here to help you lose the lease and become a homeowner in 2020!

Get in touch with one of our Loan Experts Today!

Your Tax Refund is Key to Homeownership! 5 Ways Your Tax Refund Can Help

During tax season, refunds help many become homeowners! In fact, tax refunds are often thought of as ‘extra money’ that can be used toward larger goals. If you’re expecting to get a refund this tax season, instead of spending it on things that you don’t need, consider using it to invest in your future! What better way to do so than using your tax refund to help you get closer to your homeownership dreams!

Check out these 5 ways that your tax refund can help you get closer to homeownership:

#1 Put it Towards Your Down Payment

We know that saving for a down payment can be a big challenge and even one of the biggest barriers to homeownership. Many people sometimes overestimate the size of the down payment they need. Often times, a tax refund may cover the entire down payment.

Tip: When you get your tax refund, you can put it in a savings account to build up a deposit fund. Keep adding to the fund and before you know it you could have the key to a new home in your hands! In fact, larger the deposit amount you put toward a new home, the less you will have to borrow and pay in interest over time.

Exactly how much of the down payment you can cover will depend on the amount you want to borrow and the percentage you’re required to put down. Depending on your credit history and other factors, there are financing options with much lower down payment requirements besides the typical 20% down. For instance, depending on the program, borrowers can make down payments between 3.5%-10%. Down payment assistance programs can also help you bridge the cash gap. Check out these programs here for more information.

Mortgage Products Available for First-time Buyers Offering Low to No Down Payments

Visit our website here for a list of our loan products!

#2 Apply it to Closing Costs:

You can even put your tax refund towards closing costs that can be incurred when buying a home such as: attorney fees, appraisal and inspection fees, title insurance, escrow costs, etc. Speak with your loan officer to learn what fees apply.

#3 Put it towards Taxes & Insurance:

After you’ve purchased your home, you may need to pay your property taxes and home insurance costs, which is where your tax refund can come into play.

#4 Use it to Cover Moving Costs:

It is possible you’ll have moving expenses to deal with such as renting a moving truck, purchasing packaging material, paying utility service deposits and more! This is a great way to utilize your tax refund!

#5 Use it to Build an Emergency Fund

Every homeowner should have an emergency fund – a savings account with a balance that can cover several months of expenses, which includes your mortgage payment. You could add your tax refund to your emergency fund to help protect you from financial issues in the case you have any unexpected expenses, such as a major car repair or natural disaster, or in the event of job loss, illness or other income interruption.

These are just a few ways that you can put your tax refund to good use! When you’re ready to explore your homeownership, options get in touch with Greenway Mortgage. We’ll help you find the best program and guide you through the entire process! Visit our website to learn more about our loan programs.

Bottom line:

During tax season, many tax payers have more funds than any other time of the year, so there is no better time to qualify for a new home. This is a great opportunity – low rates, stable job market, and affordable homes. Why not buy a home now?

Ready to Take the Next Step?

Greenway Mortgage is here to help. Contact us today to discuss your options. 732-832-2967.

.jpg)

.jpg)