One of the benefits of home ownership is the opportunity to build home equity. But what is home equity and why should you want it?

First let's define "home equity." In the simplest terms, equity is the difference between how much your home is worth and how much you owe on your mortgage.

Now let's figure out exactly how much home equity you have. If you paid cash for the entire asking price of your home, you own 100% of the equity in it.

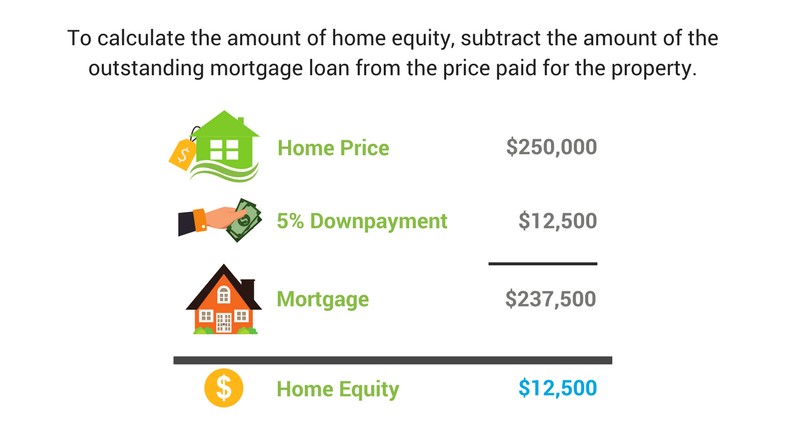

If you took out a mortgage, subtract the amount of your loan from the price you paid for your home. Let's say you and the property's seller agreed on a price of $250,000. You decided to put down 5% of the purchase price, which is $12,500, and you borrowed $237,500. That means you have $12,500 of home equity, assuming the property appraised for $250,000.

In other words, your home equity is the difference between the appraised value of your home and the amount you currently owe on your mortgage.

There are two ways to build equity:

- Increase the value of your property.

- Decrease the amount of debt on your property.

You can increase the value of your property by installing attractive landscaping and remodeling the kitchen and bathrooms, for example.

You can also let the value of your home grow over time. If you live in an increasingly popular neighborhood where property values are going up overall, then it's realistic to expect that your home equity will increase as well.

However, it's important to note that some markets appreciate faster than others. It's also possible for home values to depreciate due to economic conditions, the condition of your home deteriorating, or a drop in neighborhood home values.

You'll automatically decrease the amount of your mortgage loan by making your monthly mortgage payments. If you want to whittle it down even more, try to pay a little bit extra each month.

Now that you've built up your home equity, what can you do with it? If your family is growing and it's time to buy a bigger home, you can sell your house and you'll get cash in return for your equity. You can then use that cash for the down payment on a bigger place.