5 Biggest Questions This Holiday Season About Real Estate & Mortgages

As we gather with family and friends this holiday season you know what that means. There’s going to be lots of talk about the real estate market, mortgages, and interest rates; especially if you have an aunt, uncle, mother, father, cousin, or friend who’s house hunting.

There’s a lot of speculations about what’s going on and what the future holds. In today’s blog we want to take a few minutes to educate you on what’s really happening. So, sit back and get cozy, we’ve got the answers to 5 of the most popular questions in real estate and mortgages this holiday season.

Question #1: What Will Happen with Home Prices?

If you listen to the news often or read media headlines the housing market and our economy is probably top of mind. While no one has a magic ball to forecast the future, there is data and experts who can provide some insight.

Without a doubt homes are staying on the market longer than they were before. The days of a large influx of new listings is over. Experts say it’s still a seller’s market. Why? Because prices are driven by supply and demand, and we still have a low supply of homes on the market. This means continued upward pressure on home prices.

Question #2: Will there be a housing crisis?

Redfin sums this question up best: “For those bearish folks eagerly awaiting the home price crash, you’ll have to keep waiting. As much as demand is pulling back, supply is as well. And that’s reducing downward pressure on prices in the short run.”

All in all, some experts are projecting slight appreciation and others are calling for a slight deprecation. In turn, they see relatively neutral or flat home price appreciation for 2023.

Question #3: What’s Going to Happen with Mortgage Rates

This may be the biggest question of all. It’s safe to say we were all spoiled by incredibly low interest rates during the pandemic. Rates have more than doubled in less than a year, something that has never been seen before. According to Keeping Current Matters, the average monthly mortgage payment is about $1,000 more than it was a year ago in 2021. Why is this happening? Inflation. The FED has been making moves to help slow the economy and real estate plays a big part in our economy.

George Ratiu, manager of Economic Research at Realtor.com says, “With inflation still running at a 40-year high and the Fed expecting a few more rate increases to combat it, mortgage rates will experience upward pressure through the end of 2022.”

If inflation stays high, so will mortgage rates. When inflation starts to pull back, mortgage rates should too.

Question #4: If a recession is called, how will it impact the housing market?

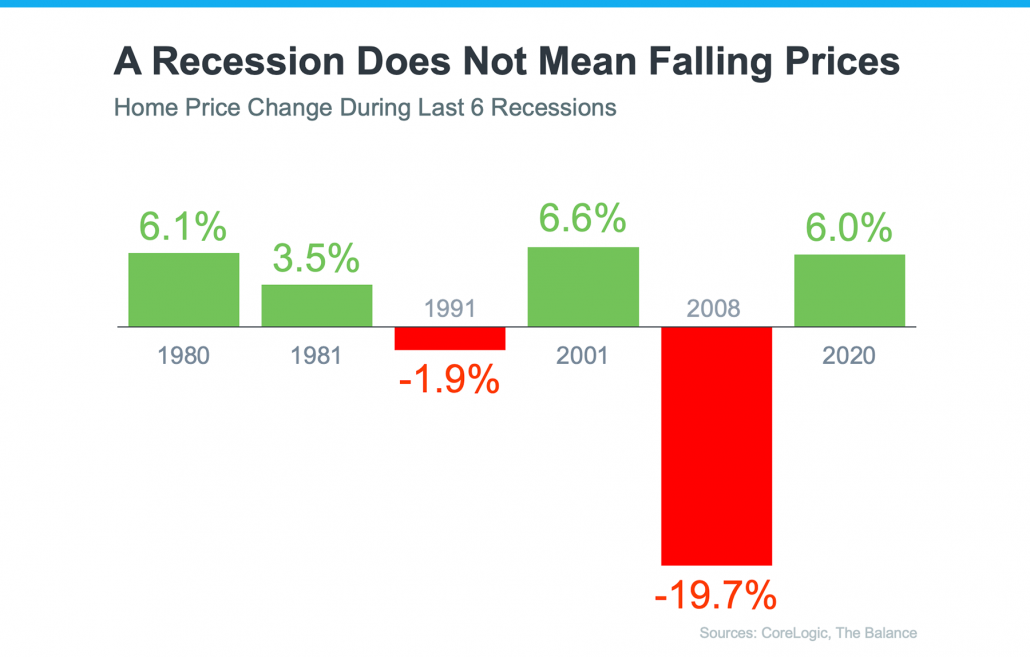

First, a recession does not mean falling home prices. In the past 6 recessions, only 2 of them saw a decrease in home prices. A recession may not always cause home prices to fall, but it generally means mortgage rates will.

Question #5: Should I Buy a Home Right Now?

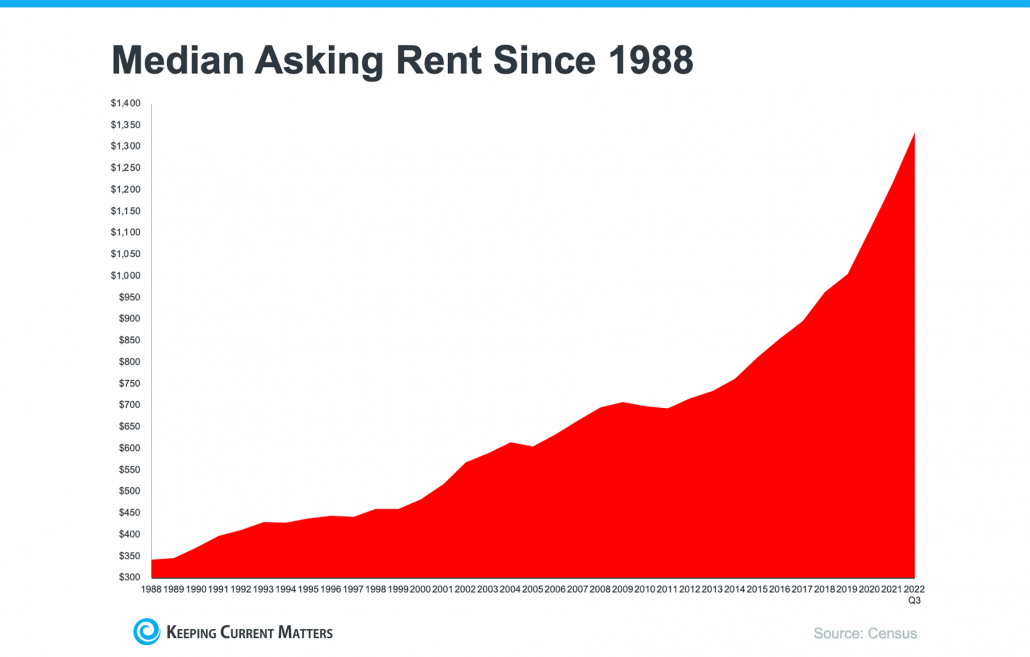

This answer can differ for every home buyer. For instance, first-time homebuyers may want to consider rising rent. Homeownership gives you the chance for a stable monthly mortgage payment all while building wealth. It also offers security and a sense of accomplishment that renting unfortunately cannot.

Another important factor to take into consideration is personal situations. For instance, some jobs may require relocations, aging parents may need to move in, etc. This all plays into whether or not buying a home or selling right now is the right time for you.

Overall, homeownership has many financial and non-financial benefits. The biggest one is that you’ll build wealth.

We’ll leave you with this quote from Odessa Kusi, deputy chief economist of First American, “If you can find a house that meets your financial expectations for a monthly payment and it is a good time for you to buy, then do that…And if you wait for prices to fall and they never do, you may discover the hard way that the house you found a year ago that you really loved, that you could afford but you passed on, is more expensive next year.”

Bottom Line:

There’s no “right” time to buy. Ultimately, the right time is when you are ready. The biggest takeaway is that you shouldn’t let today’s rates keep you from buying a home. Greenway Mortgage offers a variety of loan programs, and we can find one that best fits your financial situation. All it takes is a phone call and review to find out. Reach out and let’s see what might be possible for you today.